杜邦扩大Nomex®Paper的全球容量

|2月6日,2020年

持续投资以满足日益增长的市场需求

威尔明顿,德尔。,2月6日,2020年2月6日 -Nomex®的制造商Dupont宣布,它将在杜邦™Nomex®Paper的全球容量中显着扩展。这项投资直接支持我们继续承诺增加和维持供应可靠性,以更好地满足航空航天,汽车和电气基础设施市场的日益增长的需求。必威官网是多少将通过与Nippon Papylia的合资合作伙伴关系创建此容量扩展。帕珀尼亚制造工厂将位于日本的Yufutsu,开发的商业生产于2021年。

“Nomex®为全球数百万人和关键流程提供无与伦比的保护,并赋予无限的可能性,”杜邦安全与施工部全球副总裁兼总经理John Richard说杜邦致力于创造可持续的创新,以帮助我们的客户和世界繁荣。增加我们的全球供应以应对不断增长的市场只是我们如何履行承诺的一个例子。”

基于NOMEX®的解决方案需求是由自动电气化,能量脱碳,热保护和轻量级的创新和增长趋势驱动。

Nomex®Paper是一种在汽车电气化的关键促进技术,全球XEV电驱动电动机的绝缘,同时必威官网是多少也保护电力电子和电池系统内的关键部件。NOMEX®的质量和一致性与其优越的机械和电气性能相结合,使其成为全球OEM和第1层供应商的首选产品。通过实现更安全的能量存储系统,电动机效率和充电站安全,Nomex®Paper有助于我们的客户更好地满足他们的创新和可持续发展目标。

在纸张和压板形式中,Nomex®满足了电气工业的不同需求。其固有的阻燃性与高水平的电气,化学和机械完整性相结合,使Nomex®非常适合广泛的电绝缘应用。基于Nomex®的设计支持苛刻环境中可靠性的不断增加 - 同时支持可再生能源的市场增长,网格恢复力和数据中心。

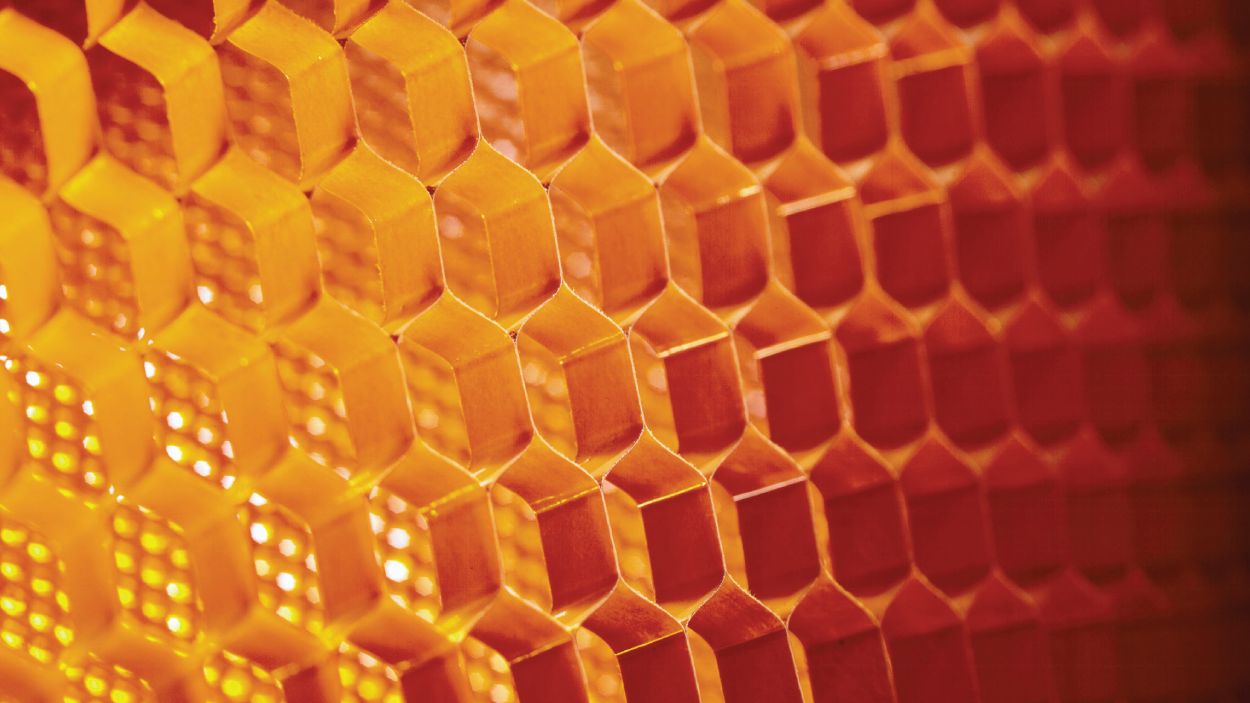

Nomex®纸制成的轻质复合材料可用于广泛的航空航天应用,包括座舱地板、高架箱和舱壁、起落架门等。Nomex®纸蜂窝复合材料固有的阻燃性、轻质强度和耐久性有助于减轻重量,从而提高燃油消耗率和降低二氧化碳排放。50多年来,这些解决方案一直是商用飞机内部和外部结构的关键组成部分。

有关更多信息,请访问www.nomex.com。

关于杜邦安全与建筑

杜邦安全与建筑是一种全球领导者,在水,庇护和安全方面提供生命的基本需求的创新;使客户能够通过独特的能力,全球规模和标志性品牌赢得,包括Dupont™Corian®,Kevlar®,Nomex®,Tyvek®,GreatStuff™,泡蛋白酶™和filmtec™。

关于杜邦

杜邦(纽约证券交易所:DD)是一种全球创新领导者,具有基于技术的材料,配料和解决方案,可帮助改变行业和日常生活。我们的员工采用多样化的科学和专业知识,以帮助客户推进他们的最佳创意,并在包括电子,运输,建筑,水,健康和健康,食品和工人安全的主要市场中提供必要的创新。更多信息可以找到www.ljlcyg.com.。

关于前瞻性陈述的警告声明

该沟通在联邦证券法中的含义内包含“前瞻性陈述”,包括1933年的“证券法”第27A条,如修订,以及1934年证券交易所第21E条,如修订。在这方面,前瞻性陈述往往地满足预期的未来业务和财务绩效和财务状况,通常包含“期待”等词语“预期”,“打算”,“计划,”“求,”“求,”“请参阅,”“意志”,“\”,“目标,”和类似的表达和这些词的变化或否定。

2019年4月1日,本公司通过职业奖励的所有Dow Inc.(“Dow Distribution”的所有杰出股票完成了物料科学业务分为单独和独立的公共公司。)。本公司于2019年6月1日完成了其农业业务将其农业业务分解为一家独立的独立公共公司,以Pro RATA股息的所有股票股票在Corteva,Inc。(“Corteva Distribution”(“Corteva Distribution”))。

On December 15, 2019, DuPont and IIF announced they had entered definitive agreements to combine DuPont’s Nutrition & Biosciences business with IFF in a transaction that would result in IFF issuing shares to DuPont shareholders, pending customary closing conditions, other approvals including regulatory and that of IFF’s shareholders.

前瞻性陈述涉及不同程度,不确定和受风险,不确定性和假设的事项,其中许多超出了杜邦的控制,这可能导致实际结果与任何前瞻性陈述中表达的结果不同。前瞻性陈述不保证未来结果。Some of the important factors that could cause DuPont's actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction with IFF; changes in relevant tax and other laws, (ii) failure to obtain necessary regulatory approvals, approval, if required, of IFF’s shareholders, anticipated tax treatment or any required financing or to satisfy any of the other conditions to the proposed transaction, (iii) the possibility that unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies that could impact the value, timing or pursuit of the proposed transaction, (iv) risks and costs and pursuit and/or implementation of the separation of the N&B Business, including timing anticipated to complete the separation, any changes to the configuration of businesses included in the separation if implemented, (v) risks and costs related to the Dow Distribution and the Corteva Distribution (together, the “Distributions”) including with respect to achieving all expected benefits from the Distributions; restrictions under intellectual property cross license agreements; non-compete restrictions; incurrence of significant costs in connection with the Distributions, including costs to service debt incurred by the Company to establish the relative credit profiles of Corteva, Dow and DuPont and increased costs related to supply, service and other arrangements that, prior to the Dow Distribution, were between entities under the common control of DuPont; indemnification of certain legacy liabilities of E. I. du Pont de Nemours and Company ("Historical EID") in connection with the Corteva Distribution; and potential liability arising from fraudulent conveyance and similar laws in connection with the Distributions; (vii) failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes, including meeting conditions under the Letter Agreement entered in connection with the Corteva Distribution, related to the transfer of certain levels of assets and businesses; (viii) uncertainty as to the long-term value of DuPont common stock; (ix) potential inability or reduced access to the capital markets or increased cost of borrowings, including as a result of a credit rating downgrade and (x) other risks to DuPont's business, operations and results of operations including from: failure to develop and market new products and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market acceptance, rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage process safety and product stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and currency exchange rates; changes in political conditions, including tariffs, trade disputes and retaliatory actions; impairment of goodwill or intangible assets; the availability of and fluctuations in the cost of energy and raw materials; business or supply disruption, including in connection with the Distributions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for DuPont, adversely impact demand or production; ability to discover, develop and protect new technologies and to protect and enforce DuPont's intellectual property rights; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management's response to any of the aforementioned factors. These risks are and will be more fully discussed in DuPont's current, quarterly and annual reports and other filings made with the U.S. Securities and Exchange Commission, in each case, as may be amended from time to time in future filings with the SEC. While the list of factors presented here is considered representative, no such list should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. DuPont assumes no obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part II, Item 1A) of DuPont’s Quarterly Report on Form 10-Q for the period ended September 30, 2019 and its subsequent reports on Form 10-Q, 10-K and Form 8-K.

#########

20120年2月2日

Dupont™,Dupont椭圆徽标以及用™,℠或®表示的所有商标和服务标志由Dupont de Nemours,Inc。的附属公司拥有。除非另有说明,否则除非另有说明。

媒体联系方式: